Afraid of a new crisis is not only Europe but also Australia and China, according to the Bank for International Settlements.

Out of Greece from the euro zone will trigger a new wave of recession, economists believe / globalpost.com

Economists from around the world speak with one voice about the impending second wave of recession-induced debt crisis in Greece. As a result, the theoretically possible yield of this country from the euro zone may be affected not only Europe and the United States, but such pace-makers of the world economy as China and India, writes slon.ru.

To assess the vulnerability of different countries to economic shocks, the Bank for International Settlements suggests to use the debt service ratio of the private sector and households. Calculated it is simple: debt service (interest plus repayment of principal) are divided into the company's income or household. Accordingly, the higher the percentage, the more vulnerable a particular sector of the economy.

The most delicate in terms of debt, the situation among the 16 surveyed countries, the BIS - in Australia. There, the debt service of the private sector is the sum of which exceeds one-third of income (almost twice the median level of 17.8%). Second place is shared by private entrepreneurs in China, Ireland and Norway, where the share of the costs of these needs varies between 27% and 28%.

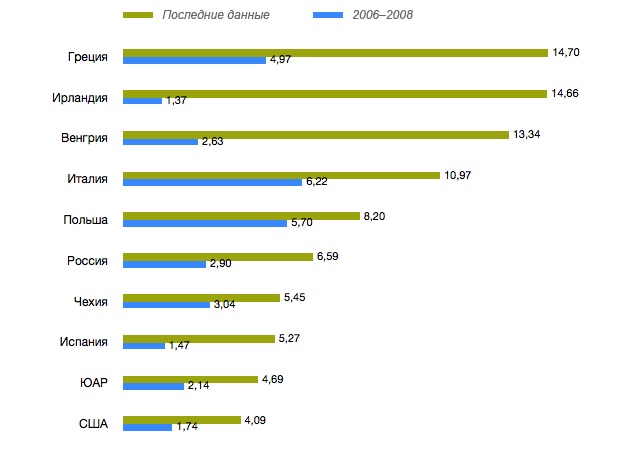

Another important indicator - the share of overdue loans to total lending to the economy (see table). Most of the figure after the 2066-2008 years. (Ie after the start of the global financial crisis) has grown in the PIGS (Portugal, Italy, Greece, Spain), once again confirming the validity of this abbreviation, and in Hungary. And here, for example, in India, Indonesia and Turkey, the proportion of bad debts, on the contrary, decreased.

The share of overdue loans,%:

No comments:

Post a Comment